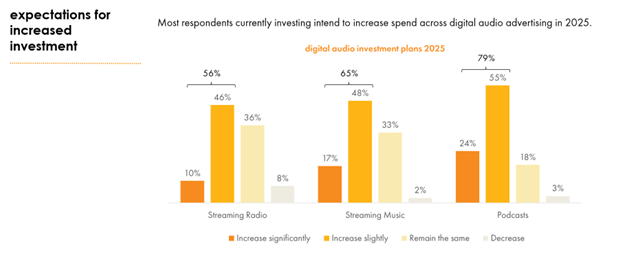

Podcast advertising is firming up as an agency favourite for 2025, according to IAB Australia’s Australian Audio State of the Nation Report, with 79% of agencies intending to increase their podcast investments this year. Streaming music (65%) and streaming radio (56%) will also see increases in spend according to the Report, with audio’s ability to offer incremental reach on other media and to compliment the media mix, flagged as the key drivers of growth.

The Report, which is in its 9th year, is a collaborative industry project which covers the usage and attitudes to advertising in streaming music and radio, and podcasts original content and catch-up radio.

It found that branding remains the main objective for most digital audio campaigns, though it highlighted an increase in use of streaming audio and podcasts to improve brand perceptions or to inform or educate with storytelling.

Gai Le Roy, CEO of IAB Australia commented: “The Report highlights the strength of the digital audio ad industry in terms of investment but also its expansion within the digital ecosystem. Agencies and marketers are applying the same measurement techniques to digital audio as they do to video. They are also exploring the role of podcasters in the creator economy and capitalising on the growing trend of video-enabled podcasts.”

Steve Golding, Chair of the IAB Audio Council and Head of Audio Automation at NOVA Entertainment commented: “It is pleasing to see the report reflect the uptick in the number of advertisers using programmatic buying for digital audio inventory, offering both increased options for existing audio advertisers as well as welcoming a range of new digital advertisers.”

Other key findings of the Report include:

Programmatic digital audio buying was found to have increased, with 78% of agency respondents indicating their intention to buy digital audio programmatically in 2025. This is up from 72% of agencies buying audio programmatically in 2024, and from 63% in 2023. The report found that cross channel frequency management and the ability to use client data helped drive programmatic trading growth, alongside data and targeting, reporting and attribution, and flexibility. Buying retail or in-store audio also increased significantly year on year.

In 2024, agencies broadened their use of podcasts beyond the usual favourite of lifestyle, health and wellness, investing strongly in other genres including society and culture podcasts (up 12%), news and current affairs (up 10%) and true crime podcasts (up 9%). The increase in true crime podcast advertising follows the 2024 IAB Australia ‘Crime Pays’ Report which showed true crime podcast content delivers engagement and memorability at levels know to influence consumer decisions and change behaviour.

Podcasts were also seen by 87% of respondents as providing new marketing opportunities in the creator economy, thanks to the partnership between podcast creators and advertisers. Previous global reports about the creator economy have focused on the value of traditional video and social media influencers, overlooking podcaster’s ability to build extraordinary communities and foster deep emotional connections that offer great value for marketers.

Measurement and evidence of effectiveness continued as the top issues preventing streaming digital audio and podcast advertising from being a larger proportion of ad volume. The report also found that a lack of standardised audience data for media planning underpinned the measurement challenges. Aside from these issues, respondents indicated that more sophisticated targeting and personalisation capabilities, along with improved programmatic supply, more transparency in ad verification and greater media owner collaboration and integration with other media would all help growth in the audio industry,

The Report was supported by industry body Commercial Radio & Audio, as well as 18 different media and tech companies, including Acast, GroupM, Nine, The Trade Desk, ARN, Eardrum, Earmax, Magnite, Nova, SCA, Triton, Zenith, Blis, Google, News Corp Australia, Publicis Groupe, Spotify and Yahoo!.

Fieldwork was conducted in December 2024 and January 2025 with 133 survey responses collected from the advertising buy-side including media, creative and digital agencies, agency trading desks and brands/companies that buy advertising. 88% of respondents were from agencies and 12% from brands or companies that buy advertising direct.

The Report comes just days after the release of the IAB Australia Internet Advertising Revenue Report which found digital audio revenue reached $313m for CY24.

IAB Australia offers a free Foundations of Digital Audio Advertising course for marketers and newcomers who would like to learn more about the audio landscape, platforms, planning, advertiser appeal, audience targeting, creative crafting, advanced measurement and more.

/ Ends

About the Interactive Advertising Bureau

As an independent industry association with more than 170 members in Australia and nearly 9,000 globally spanning media owners, publishers, technology companies, agencies, and advertisers, IAB works to align industry stakeholders to develop solutions for the issues faced by the market and develop standards that are integral to the operation of digital advertising.

As one of 47 IAB offices globally, the role of the IAB is to support sustainable and diverse investment in digital advertising across all platforms in Australia as well as demonstrating to marketers and agencies the many ways digital advertising can deliver on business objectives.