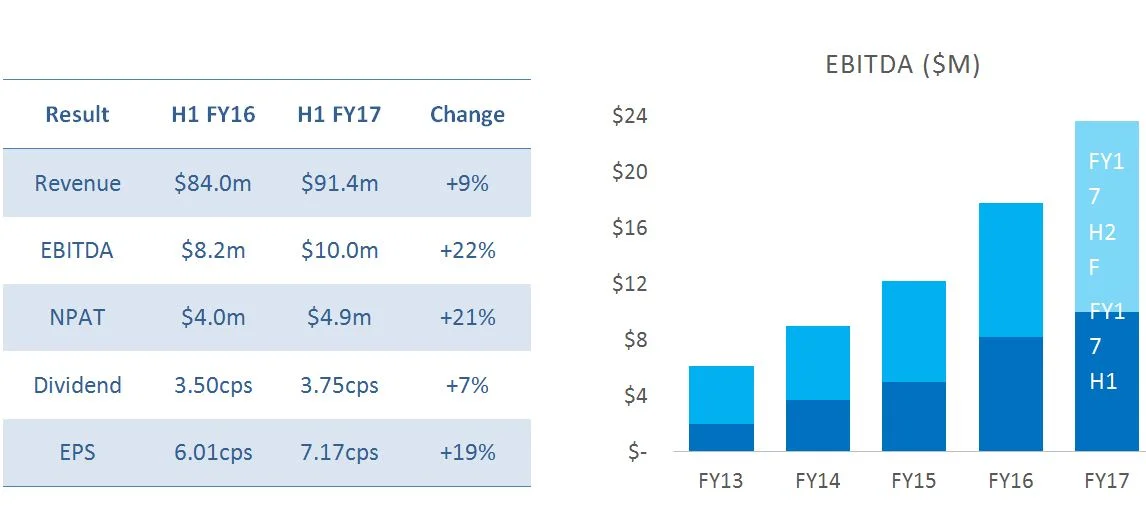

EBITDA up 22% to $10m & NPAT up 21% to $4.9m

Sydney – 14 February 2017 -The Board of Australian communications specialist MNF Group (ASX:MNF) is very pleased to report strong organic growth for the six months ended 31 December 2016. Earnings before interest, tax, depreciation and amortisation (EBITDA) increased by 22% to $10.0 million, with net profit after tax (NPAT) increasing by 21% to $4.9 million, compared with the same period a year earlier. Revenue for the half increased organically by 9% to $91.4 million.

The company’s solid performance for the half included:

The large increase in net profit for the period versus the prior corresponding period are attributable to solid organic growth in all three operating segments: Domestic Retail, Domestic Wholesale and Global Wholesale:

- The Domestic Retail segment benefitted strongly from recent success in the Government segment, with gross margin up 12% on prior year; this segment is expected to continue to perform strongly with the recent announcement that MNF has been selected for the Victorian Government TPAMS panel.

- The Domestic Wholesale segment continues its strong organic growth due to the monotonic increase in its recurring revenue streams; this segment is also expected to continue this momentum as well as adding additional revenue streams in the form of the Telstra Wholesale MVNO agreement which was announced in December 2016.

- The Global Wholesale segment contributed strong growth during the period, and is expected to continue to perform well with the addition of its new PoP in Hong Kong launched only in December 2016.

Business Outlook and Guidance:

The directors believe the business is currently on track to meet our previously stated organic forecast. Subsequent to the half year end, MNF announced the acquisition of Conference Call International (CCI). The combined business will produce an upgraded 2017 forecast with EBITDA and NPAT of $23.7m and $11.6m respectively, and a revised EPS forecast to 16.7cps after capital raising dilution.

With a discerning and conservative approach, the Board of MNF Group will continue to actively search for further acquisition opportunities; whilst we remain totally committed to driving growth and performance within the business. The criteria being sought after are: customer bases which can be migrated to the company’s network giving a high return on investment, or intellectual property and network assets which can be integrated into the company’s existing eco-system to provide additional growth opportunities, or additional capabilities which complement the company’s stated strategies.

The MNF Group board remains very confident that the company will achieve strong organic growth in the coming year and well into the future.

Investor Teleconference:

There will be a teleconference and results presentation held on Tuesday 14 February at 4:00 pm AEDT. For details please check http://mnfgroup.limited/investors A recorded version of this presentation will be made available for later viewing at the same web address.

/ENDS

About MNF Group Limited

MNF Group Limited (ASX: MNF) is one of Asia-Pacific’s fastest growing technology companies. Listed on the ASX since 2006, it is now capitalised at around $300M, and twice winner of the Forbes Asia-Pacific “Best under a Billion” award. Headquartered in Sydney, Australia, the company has over 250 people located across Asia-Pacific, Europe and North America. MNF develops and operates a global communications network and software suite enabling some of the world’s leading innovators to deliver new-generation communications solutions.

As the world moves to IP, MNF Group is building the brands, services, network and technology to lead the way.

For further information about MNF Group Limited please visit: http://mnfgroup.limited/