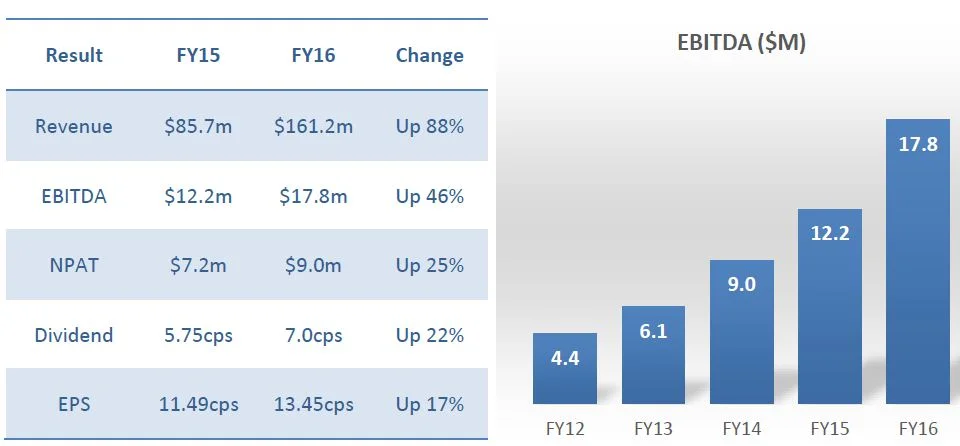

EBITDA up 46% to $17.8m

The Board of global voice specialist MNF Group (MNF) are very pleased to report another excellent profit for the full year ending 30 June 2016.

Earnings before interest, tax, depreciation and amortisation (EBITDA) rose by 46% to $17.8 million, on total revenue of $161.2 million – an increase of 88%. This produced a final net profit after tax (NPAT) of $9.0 million which is 7.0% above the company’s published forecast.

The total Dividend for the full year has increased by 22% to 7.0 cents per share fully franked, with the company now declaring a final dividend of 3.5 cents per share.

“Our strong overall performance this year is a result of solid contributions from all three segments of the business – Domestic Retail, Domestic Wholesale and Global Wholesale. Organic growth played a key role in this result, with Domestic Wholesale leading the growth with its gross profit contribution up a very solid 50% on last year.” said MNF Group CEO, Mr Rene Sugo. “The TNZI acquisition integration is progressing very well with the new Global Wholesale segment already performing above expectation, and showing excellent prospects going into FY17.” added Sugo.

The result produces a robust full year balance sheet with plenty of capacity to fund organic growth and a comfortable buffer to pursue potential acquisitions. A healthy cash balance has resulted from a combination of factors, including: final working capital adjustment from completion of the TNZI US business, finalising TNZI supplier novations, excellent receivables management, and the company’s strong EBITDA performance.

The big increase in the company’s top line revenue was largely due to the full year contribution of the TNZI Global Wholesale business (excluding the US). The US component of this transaction was completed at the end of May 2016, resulting in only 1 month of TNZI US revenue being recognised in this financial year. However, in relation to the TNZI US business, it should be noted that a full 12 months of EBITDA contribution was recognised in this result due to the interim transition arrangements in the TNZI acquisition.

TNZI Post-Acquisition Update

The integration of the TNZI acquisition is progressing well, with all major project milestones for the year having been achieved. These include – staff integration, Wellington office relocation, IT systems separation, customer & supplier novation, and US licensing & transaction completion. The global network expansion and upgrade program is well underway. The expansion of the UK (London) Point of Presence (PoP) was finalised earlier this calendar year, and the US (Los Angeles) PoP upgrade has been completed in July 2016. After some logistics delays, we can now announce that the Hong Kong PoP first phase construction has just been completed and we expect it will be fully operational very shortly.

Business Outlook and Guidance

The MNF Group is now operating three very solid and independent segments – Domestic Retail, Domestic Wholesale and the Global Wholesale. Inside each segment are multiple product lines with excellent customer diversity and profit contribution. All segments operate in our core area of expertise, being: enabling new and disruptive voice communications through software development and network deployment. Each segment has a well-defined strategy for investment & expansion to produce strong and sustainable organic growth, now and well into the future.

The Board believes that MNF Group has demonstrated its ability to harvest value from accretive acquisitions and integrate them quickly & effectively to improve the overall performance of the business. With a discerning and conservative approach, we will continue to actively search for further acquisition opportunities; whilst we remain totally committed to driving growth and performance within the business.

There will be a teleconference and results presentation held on Tuesday 16 August at 3:30 pm AET. For details please check http://mnfgroup.limited/investors A recorded version of this presentation will be made available for later viewing at the same web address.

/ENDS

About MNF Group

MNF Group Limited, (ASX: MNF) is an integrated telecommunications software and network provider, specialising in IP voice communications. MNF Group was founded in 2004 and listed on the ASX in 2006, it has 67.5 million shares on issue and has operated profitably since 2009 paying dividends to its shareholders every six months since September 2010.

The Group operates a global IP voice network carrying over 6 billion voice minutes per annum, with Points of Presence (POPs) in Los Angeles, New York, Hong Kong, Singapore, London, Frankfurt, Sydney and Auckland. Domestically, the Group operates the largest, fully interconnected IP Voice network in Australia.

MNF Group has a reputation for quality, value and innovation, being the recipient of numerous awards including the ACOMMS award for innovation (2016), the iAwards for Innovation (2016), Forbes Asia’s 200 Best Under a Billion (2014 & 2015), Deloitte Technology Fast 50 (2008, 2009, 2010, 2012, 2013, 2014) and CeBIT Outstanding Project Award (2013).

MNF Group companies includes retail brands MyNetFone, Connexus, CallStream, PennyTel and The Buzz; and wholesale brands TNZI, Symbio Networks and iBoss.

For further information about MNF Group Limited please visit: http://mnfgroup.limited/