Seagate Technology plc (NASDAQ: STX) (the “Company” or “Seagate”) today reported financial results for the third quarter of fiscal year 2015 ended April 3, 2015. For the third quarter, the Company reported revenue of approximately $3.3 billion, gross margin of 28.7%, net income of $291 million and diluted earnings per share of $0.88. On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 28.9%, net income of $357 million and diluted earnings per share of $1.08. For a detailed reconciliation of GAAP to non-GAAP results, see the accompanying financial tables.

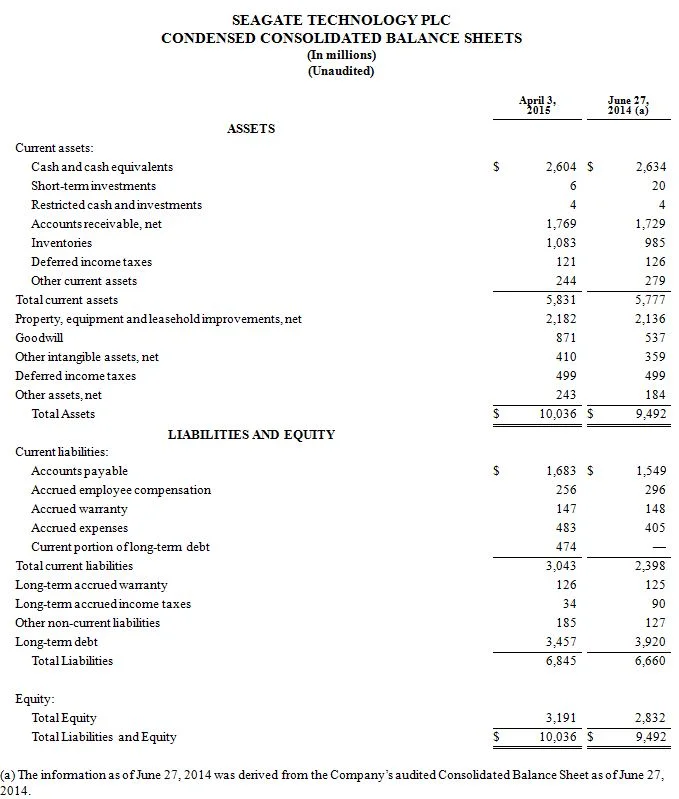

During the third quarter, the Company generated approximately $374 million in operating cash flow, paid cash dividends of $176 million and repurchased approximately 12 million ordinary shares for $706 million. Year to date, the Company has returned approximately $1.4 billion to shareholders in dividend and stock redemptions. Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.6 billion at the end of the quarter.

“In light of dynamic market conditions this quarter we are quite satisfied with our operational performance and ability to return value to shareholders,” said Steve Luczo, Seagate’s chairman and chief executive officer. “Near-term macro uncertainty is affecting certain areas of our addressable market however we remain optimistic that market demand for exabytes of storage will continue to increase over the long-term. Looking ahead, we are focused on aligning our storage technology portfolio effectively to capitalize on market growth opportunities, demonstrating operating profitability and returning value to shareholders.”

Seagate has issued a Supplemental Financial Information document, which is available on Seagate’s Investors website at www.seagate.com/investors.

Quarterly Cash Dividend

The Board of Directors has approved a quarterly cash dividend of $0.54 per share, which will be payable on May 15, 2015 to shareholders of record as of the close of business on May 1, 2015. The payment of any future quarterly dividends will be at the discretion of the Board and will be dependent upon Seagate's financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

Investor Communications

Seagate management will hold a public webcast today at 6:00 a.m. Pacific Time that can be accessed on its Investors website at www.seagate.com/investors. During today's webcast, the Company will provide an outlook for its fourth fiscal quarter of 2015 including key underlying assumptions.

Replay

A replay will be available beginning today at approximately 9:00 a.m. Pacific Time athttp://www.seagate.com/investors/.

About Seagate

Seagate creates space for the human experience by innovating how data is stored, shared and used. Learn more at www.seagate.com. Follow Seagate on Twitter, Facebook, LinkedIn, Spiceworks, Google+ and subscribe to our blog.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including, in particular, statements about our plans, strategies and prospects and estimates of industry growth for the fiscal quarter ending July 3, 2015 and beyond as well as our plans with respect to future dividend payments. These statements identify prospective information and may include words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects” and similar expressions. These forward-looking statements are based on information available to the Company as of the date of this press release and are based on management’s current views and assumptions. These forward-looking statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause actual results, performance or events to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties, and other factors may be beyond the Company’s control and may pose a risk to the Company’s operating and financial condition. Such risks and uncertainties include, but are not limited to: the uncertainty in global economic conditions, as consumers and businesses may defer purchases in response to tighter credit and financial news; the impact of the variable demand and adverse pricing environment for disk drives, particularly in view of current business and economic conditions; the Company’s ability to successfully qualify, manufacture and sell its disk drive products in increasing volumes on a cost-effective basis and with acceptable quality, particularly the new disk drive products with lower cost structures; the impact of competitive product announcements; currency fluctuations that may impact our margins and international sales; possible excess industry supply with respect to particular disk drive products and; the Company’s ability to achieve projected cost savings in connection with restructuring plans and fluctuations in interest rates. Information concerning risks, uncertainties and other factors that could cause results to differ materially from the expectations described in this press release is contained in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on August 7, 2014, the “Risk Factors” section of which is incorporated into this press release by reference, and other documents filed with or furnished to the Securities and Exchange Commission. These forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made.

The inclusion of Seagate’s website address in this press release is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, Seagate’s website is not part of this press release.

Use of non-GAAP financial information

To supplement the condensed consolidated financial statements presented in accordance with generally accepted accounting principles (GAAP), the Company provides non-GAAP measures of net income, diluted net income per share, gross margin, gross margin as a percentage of revenue, operating margin, operating expenses, and operating income which are adjusted from results based on GAAP to exclude certain expenses, gains and losses. These non-GAAP financial measures are provided to enhance the user's overall understanding of the Company’s current financial performance and our prospects for the future. Specifically, the Company believes non-GAAP results provide useful information to both management and investors as these non-GAAP results exclude certain expenses, gains and losses that we believe are not indicative of our core operating results and because we believe they are generally consistent with financial models and estimates published by financial analysts who follow the Company.

These non-GAAP results are some of the primary measurements management uses to assess the Company’s performance, allocate resources and plan for future periods. Reported non-GAAP results should only be considered as supplemental to results prepared in accordance with GAAP, and not considered as a substitute for, or superior to, GAAP results. These non-GAAP measures may differ from the non-GAAP measures reported by other companies in our industry.

A For the three and nine months ended April 3, 2015, Cost of revenue on a GAAP basis totaled $2.4 billion and $7.8 billion, while non-GAAP Cost of revenue, which excludes the net impact of certain adjustments, was $2.4 billion and $7.7 billion, respectively. The non-GAAP adjustments include amortization of intangibles associated with acquisitions and other acquisition related expenses.

B For the three and nine months ended April 3, 2015, Product development and Marketing and administrative expenses have been adjusted on a non-GAAP basis to exclude the impact of integration costs associated with acquisitions.

C For the three and nine months ended April 3, 2015, Amortization of intangibles primarily related to our acquisitions has been excluded on a non-GAAP basis.

D For the three and nine months ended April 3, 2015, Restructuring and other, net, primarily related to a reduction in our work force as a result of our ongoing focus on cost efficiencies in all areas of our business.

E For the nine months ended April 3, 2015, Gain on arbitration award, net, has been adjusted on a non-GAAP basis to exclude the final award amount of $630 million, less litigation and other related costs of $10 million, related to the arbitration award in the Company’s case against Western Digital for the misappropriation of the Company’s trade secrets.

F For the three and nine months ended April 3, 2015, Other income (expense), net has been adjusted on a non-GAAP basis mostly to exclude the partial payment of $143 million for interest accrued on the final arbitration award amount in the Company's case against Western Digital and the net impact of losses recognized on the early redemption and repurchase of debt.

G For the nine months ended April 3, 2015, Provision for income taxes, has been adjusted on a non-GAAP basis primarily to exclude the net tax expense associated with the final audit assessment from the Jiangsu Province State Tax Bureau of the People's Republic of China for changes to the Company's tax filings for the calendar years 2007 through 2013.